Solutions-Oriented Attorneys Providing Peace Of Mind

At Brown & Associates Law & Title, P.A., our solutions-oriented professionals have the experience and knowledge to provide our clients with peace of mind when faced with a legal issue. We deliver tailored legal advocacy for not only real estate legal concerns but also a variety of civil legal issues including estate planning.

Serving The Greater Tampa Bay Area For More Than 20 Years

We Deliver Unparalleled Service And Customer Satisfaction

Our goal at Brown & Associates Law & Title, P.A., is to be the leading law firm providing a broad range of legal services in the Greater Tampa Bay area and throughout the state. Our focus is serving our customers in a friendly and professional way. We have built a solid reputation for our prompt responses and our ability to quickly assemble strong strategies toward effective resolutions.

Our team values continuously developing resources that we make available for our clients. We immerse our business model in innovative team building and communication so we can offer our clients distinguished customer service. Whether you come to us for title services and real estate settlement or for civil legal representation, we aim to make the process a smooth one for you.

Real Estate Law

Title Services

Business Law

Estate Planning

Probate

Personal Injury

Tampa Bay Pitch:

Virtual Open Houses

Join us on the 2nd and 4th Thursday of every month from 9:00 a.m. to 10:00 a.m. for a session benefitting realtors, home buyers or sellers, as well as lenders. Each session, our professionals offer topics including:

- “Featured Listings”

- Buyers needs

- Realtor marketing

- Mastermind topic

- Dynamic guest speakers

You may easily register for this workshop ahead of time by contacting us at the link below.

2nd & 4th Thursday of Every Month 9:00 – 10:00 AM

Your Success Is Our Mission

We love living in Florida. We believe our state has some of the healthiest people and most vibrant businesses in the nation. Our professionals help individuals, families and business owners live their best life.

We are here to provide the land title and real estate settlement support you need, in addition to handling a wide range of other legal matters. When you have legal concerns, our lawyers are here to answer to your questions, map out your options, and provide strategies and the legal representation you need. Our mission is your success.

Call us at 813-576-3790 or send us an email to arrange for your free consultation.

Meet Our Attorneys and Staff

What Our Clients Are Saying

“I retained Brown & Associates Law & Title, P.A., to help me with a real estate matter. Barbara Brown’s reputation speaks for itself. I was also extremely impressed with the entire team. I would highly recommend using Brown & Associates Law & Title, P.A.” ̶ John Turner

“I want to commend Laura Dyer for being diligent and noticing that my client’s LLC manager and resident agent was changed on November 27, 2019 after having been the same since 2009. The change was fraudulent, and she saved us a lot of stress, expense and time as the person applied for a $500,000 loan against property owned by the LLC. Your firm has a first-class title processor!” ̶ Steve Perrone

“I have to say, I deal with A LOT of Title Companies, you by far have been the best at communication that I have dealt with in a long time, thank you thank you thank you!!!!” ̶ S.Z.

“I retained Brown & Associates Law & Title, P.A., to help me with a real estate matter. Barbara Brown’s reputation speaks for itself. I was also extremely impressed with the entire team. I would highly recommend using Brown & Associates Law & Title, P.A.” ̶ John Turner

Attorney Barbara Brown

Our Partners

Watch Our Video

Awards

Not sure what you need? How can we help?

Real Estate Law

3 common sources of real estate contract disputes

Real estate contracts are typically very dense documents. They include information about the property and the obligations of both parties involved in the transaction. The person who wants to buy the...

Safety Tips For Realtors: How To Be Diligent In Practice

Changes in technology and market practices overall have increased the levels of fraudulent activity in the practice of real estate. It is impossible to be aware of every scam that exists, but that...

Is legal action necessary to settle a boundary dispute?

A positive or neutral relationship with immediate neighbors is frequently beneficial for property owners. For example, they might cooperate to perform certain maintenance tasks, like fence repair,...

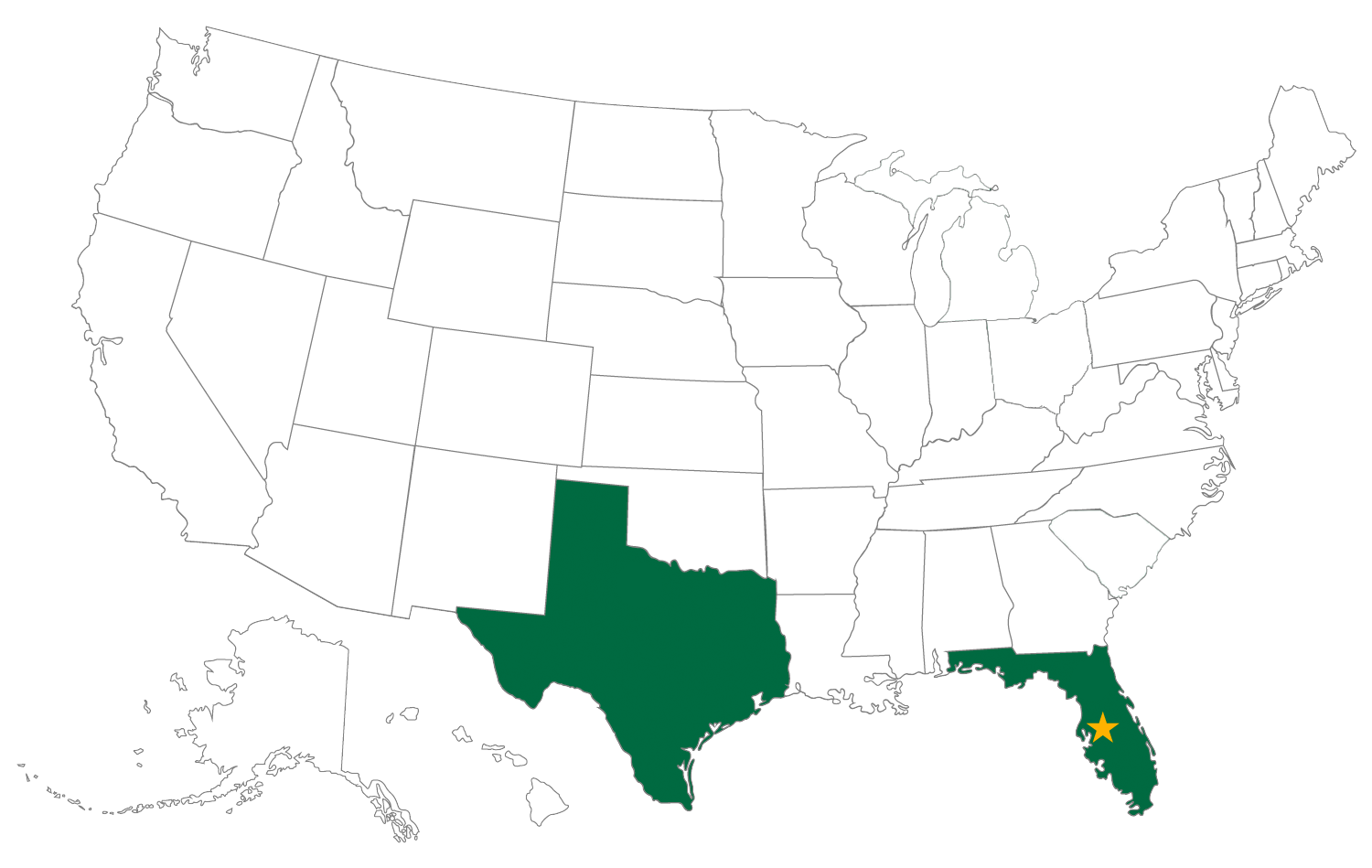

Serving Clients In These States

Title Services

What happens with a property’s title when you buy a home?

When you buy a piece of real estate, what you actually purchase is the title to the property. All of the money that exchanges hands helps ensure that you will be the official owner according to...

When is title insurance necessary?

Title insurance protects homebuyers and lenders from damages caused by a bad title. Most policies provide protection against back taxes, outstanding liens against the property, conflicting wills and...

What kind of title issue could complicate your transaction?

Maybe you inherited a piece of property from a family member, or perhaps you purchased it in a non-traditional manner, such as through a land contract. You may have become the owner without actually...

We pride ourselves on our reliability and our strong values of integrity and professionalism.